georgia ad valorem tax refund

Use Ad Valorem Tax Calculator. Exemptions may vary based on which county the veteran resides.

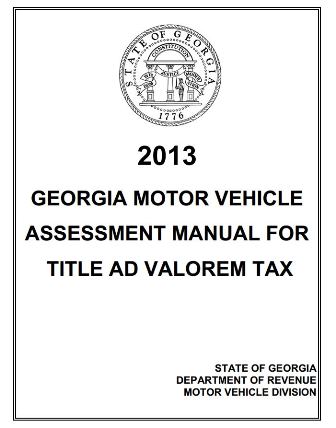

2013 Vehicle Valuation Manual Title Ad Valorem Tax Diminished Value Of Georgia

The claim for refund should be filed in writing with the board of commissioners within three years after the date of payment.

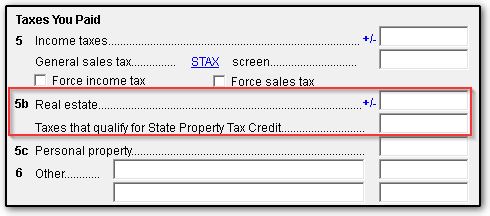

. This tax is based on the cars value and is the amount that can be entered on Federal Schedule A Form 1040 Itemized Deductions for an itemized deduction if the return qualifies to itemize deductions rather than take the standard deduction. A disabled veteran in Georgia may receive a property tax exemption of 60000 or more on hisher primary residence if the veteran is 100 percent disabled depending on a fluctuating index rate set by the US. 25 of the tax due 48-7-57.

If a vehicle is used for business the title tax should be added to the cost basis like a sales tax. 178 posts read 584702 times Reputation. The State of Georgia has an Ad Valorem Tax which is listed on the Motor Vehicle Registration certificate.

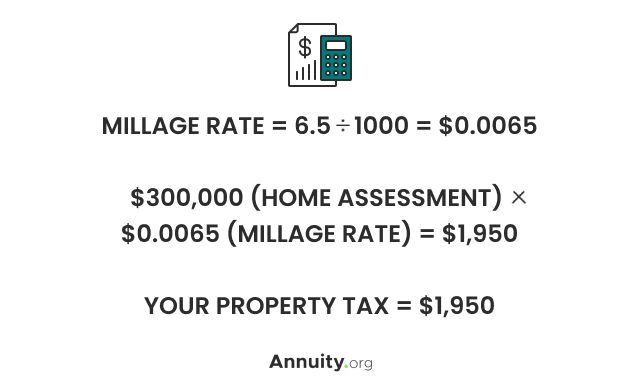

For example imagine you are purchasing a vehicle. This tax is based on the value of the vehicle. December 18 2019.

TAVT is a one-time fee that replaces the sales tax and the annual ad valorem tax often referred to as the birthday tax on motor vehicles. Ad Valorem Tax Refunds If a taxpayer discovers they have paid taxes that they believe were illegal or erroneous they may request a refund within 3 years of the date of payment. These policy bulletins outline the annual interest rates regarding refunds and past due taxes in the State of Georgia for certain tax years.

Secretary of Veterans Affairs. Vehicles purchased on or after March 1 2013 and titled in Georgia are exempt from sales and use tax and the annual ad valorem tax ie. The property taxes levied means the taxes charged against taxable property in this state.

The tax must be paid at the time of sale by Georgia residents or within six months of establishing residency by those. Some of the taxes levied may not be collected for various reasons assessment errors insolvency bankruptcy etc. Instead the purchased vehicles are subject to a one-time title ad valorem tax TAVT.

The links below are reports that show the ad valorem taxes that were levied by local counties schools and cities for the indicated tax year. 5 of the tax not paid by the original due date and an additional 5 for each additional month the return is late. The deductions typically adjust up with inflation every year.

The minimum is 725. Ad Ask Verified Tax Pros Anything Anytime 247365. If you purchased your vehicle in Georgia before March 1 2013 you are subject to an annual tax.

If itemized deductions are also. CHAPTER 5 - AD VALOREM TAXATION OF PROPERTY. Check For The Latest Updates And Resources Throughout The Tax Season.

For the 2014 tax year the standard deduction is worth 6200 9100 or 12200 depending on if you file taxes alone as a head of household or as a married couple filing jointly. 48-5-241 - Refund or credit of county taxes. This ad valorem tax is deductible each year.

Ad Learn About The Common Reasons For A Tax Refund Delay And What To Do Next. Ad Valorem Vehicle Taxes. Refund or credit of county taxes.

TITLE 48 - REVENUE AND TAXATION. This calculator can estimate the tax due when you buy a vehicle. Like say for example I moved out of Georgia for a while and came back with the same car I wouldnt re-owe the tax would I.

To itemize your deductions for ad valorem taxes you have to give up your standard deduction. In the most recent legislative session the Georgia General Assembly passed Senate Bill 65 which made several changes to the title ad valorem tax TAVT code sections which apply to vehicles purchased or sold on or after January 1 2020. I called the GA tag office and they said there are no refunds issued for ad valorem taxes that are paid up front.

Ad Get Access to the Largest Online Library of Legal Forms for Any State. Ad valorem tax for state purposes will be due on the assessed value of land that exceeds the 10 acre limitation. Multiply the vehicle price before trade-in or incentives by the sales tax fee.

GA Code 48-5-47 65 Years of Age and Low Income Exemption Individuals 65 Years of Age and Older May Claim a 4000 Exemption. ARTICLE 4 - COUNTY TAXATION. The TAVT rate will be lowered to 66 of.

The Title Ad Valorem Tax TAVT or Title Fee was passed by the 2012 Georgia General Assembly with additional amendments made during the 2013 legislative session. For the answer to this question we consulted the Georgia Department of Revenue. Failure to pay the tax due on the original return due date regardless of whether the return is filed 05 of the unpaid tax due and an additional 05 of the outstanding tax for each.

Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms. For vehicles purchased in or transferred to Georgia prior to 2012 there is still an ad valorem tax assessed annually and based on the value of the vehicle. A In all cases where a person has been overtaxed or claims for any reason that taxes should be credited or refunded.

11-21-2013 1009 PM Jimmeh. The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state. To calculate the sales tax on your vehicle find the total sales tax fee for the city.

The two changes that apply to most vehicle transactions are.

Having Rental Property Gains In Hungary See Your Tax Obligations

Ad Valorem Tax Overview And Guide Types Of Value Based Taxes

Property Overview Cobb Tax Cobb County Tax Commissioner

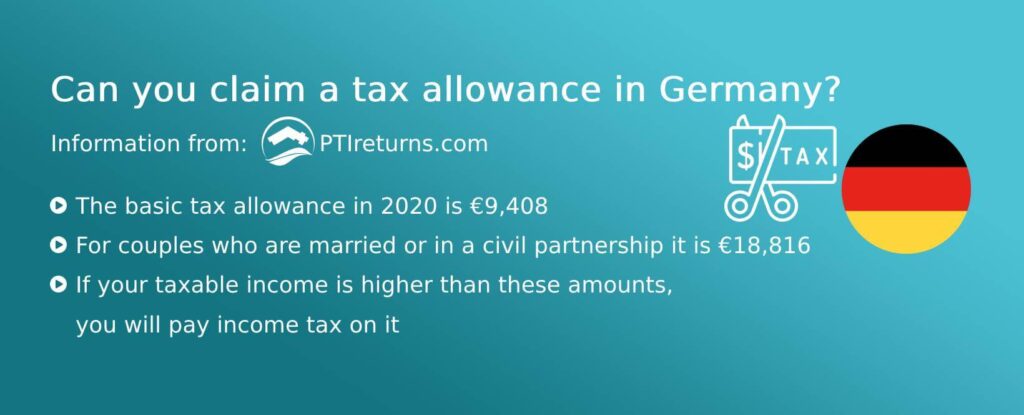

German Rental Income Tax How Much Property Tax Do I Have To Pay

How Taxes On Property Owned In Another State Work For 2022

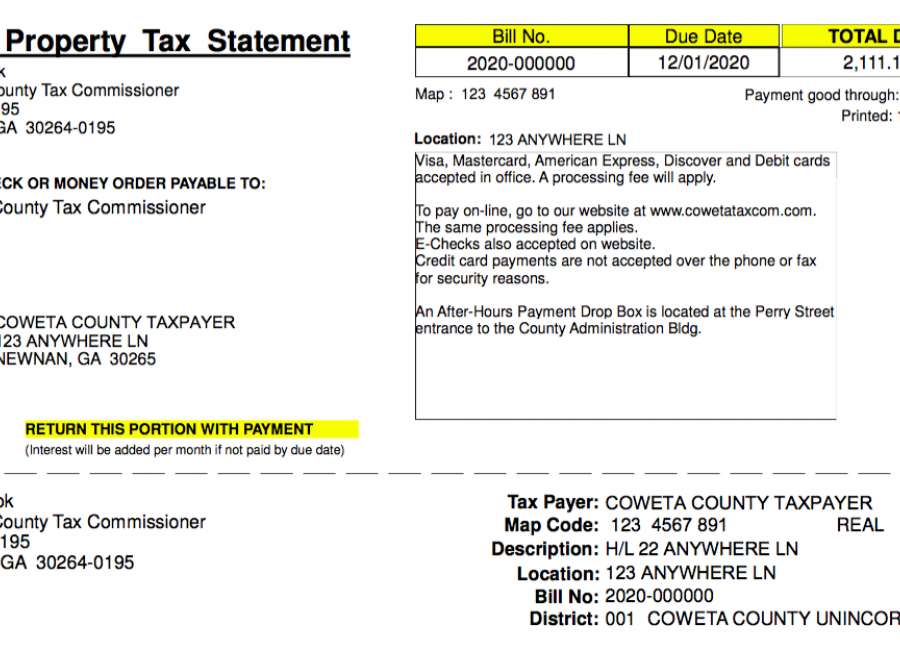

Property Tax Bills On Their Way The Newnan Times Herald

What Are Ad Valorem Taxes Henry County Tax Collector Ga

Property Tax City Of Commerce City Co

Changes In Georgia S Ad Valorem Tax

Get Paid To Complete Offers At Treasuretrooper Com Offer Completed Paying

What Is A Homestead Exemption And How Does It Work Lendingtree

Cypress Texas Property Taxes What You Need To Know

2021 Property Tax Bills Sent Out Cobb County Georgia

Ad Valorem Tax Definition Day Trading Terminology Warrior Trading